- Binance fined $2.25 million by India's FIU for non-compliance with local anti-money laundering laws.

- It can now re-enter the Indian market, contingent upon payment of the penalty and compliance with local regulations.

In January, India's Financial Intelligence Unit (FIU) blocked Binance and eight other foreign cryptocurrency platforms from operating in India through their websites and apps due to violations of FIU and anti-money laundering regulations.

However, in April, reports indicated that Binance planned to restart its operations in India by paying a $2 million fine, aiming to re-register as a business with the FIU under the Finance Ministry.

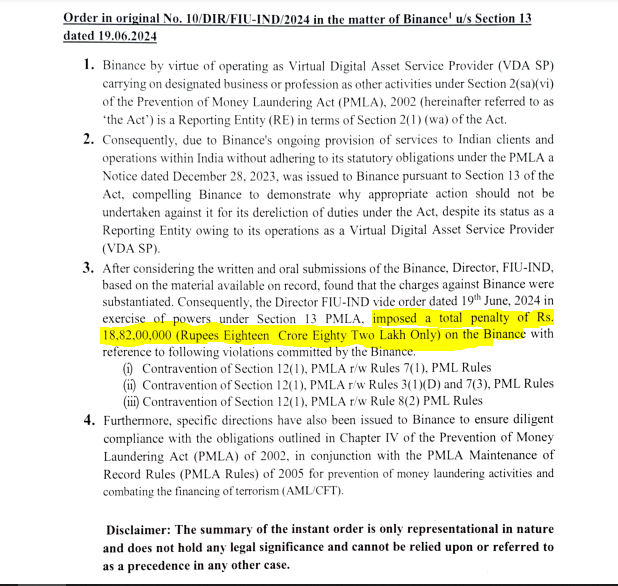

In a recent update, Binance was fined $2.25 million (₹18.8 crore) by India's FIU for operating before December 2023 without following local anti-money-laundering laws. The fine allows Binance to resume operations in India, provided it pays the penalty and adheres to regulations.

The FIU stated that the fine was imposed because Binance continued serving Indian clients and operating in India without meeting its legal obligations under the Prevention of Money Laundering Act (PMLA), 2002. A formal notice was issued to the company under Section 13 of the PMLA on December 28, 2023.

"We are aware of the FIU's order and are reviewing it now to determine next steps. We are grateful to have the opportunity to continue our mission to serve the vibrant Indian crypto community. We wish to work with the FIU as a reporting entity and we are enthusiastic about reentering the Indian market to contribute positively, should we be able to do so in the near future, " a Binance spokesperson said.

In India, cryptocurrency exchanges must register with the Financial Intelligence Unit (FIU) as reporting entities and adhere to local anti-money laundering regulations. They are also required to withhold taxes on cryptocurrency transactions and profits.

Among the exchanges that were previously blacklisted, Seychelles-based KuCoin was the first to comply with Indian regulations, achieving compliance within a month by paying a penalty of 3.45 million rupees.

As part of its FIU registration, KuCoin announced several initiatives to enhance its services in India. These initiatives include introducing local payment solutions through partnerships with Indian banks and financial entities, making it easier for Indian users to access cryptocurrency trading.

Edited by Harshajit Sarmah